are full dental implants tax deductible

Preventive treatment includes the services of a dental hygienist or dentist for such procedures as teeth cleaning the application of sealants and fluoride. Employer-sponsored premiums paid under a premium conversion plan cafeteria plan or any other medical and dental expenses paid by the plan arent deductible unless the premiums are included in box 1 of your Form W-2 Wage and Tax Statement.

Dental Implant Cost Dental Implants Start From 900

22 2022 Published 512 am.

. Other dental work not paid by your insurance plan. Is there anything else the Accountant should be aware of. Medical expenses are an itemized deduction on Schedule A and are deductible to the extent they exceed 10 of your adjusted gross income AGI.

If your treatment for implant or cosmetic dentistry is 50000 then 45125 is fully tax deductible. You can include in medical expenses the amounts you pay for the prevention and alleviation of dental disease. Yes Dental Implants are Tax Deducible.

Author has 249 answers and 208K answer views 8 mo. Procedures such as teeth whitening and porcelain veneers are not tax deductible since they are. While dental implants arent specifically mentioned in IRS Publication 502 the IRS says.

If you do not like the sound of itemizing your taxes another way to save money would be to budget ahead of time with your Flex Spending Account FSA or Health Savings Account HSA. Remember though that your itemized deductions for medical dental expenses are reduced by 75 of your Adjusted Gross Income AGI and that total itemized deductions including. You will have to file an itemized tax return to benefit from care.

If they were performed to repair damaged teeth and restore oral health the answer is most. You can include in medical expenses the amounts you pay for the prevention and alleviation of dental disease. Payments of fees to doctors dentists surgeons chiropractors psychiatrists psychologists and nontraditional medical practitioners.

This is only useful to you if your write-offs are greater than the standard deduction. For 2017 and 2018 you may deduct only the amount of your total dentalmedical expenses that exceeds 75 of your adjusted gross income. The cost was 40000 full set top and.

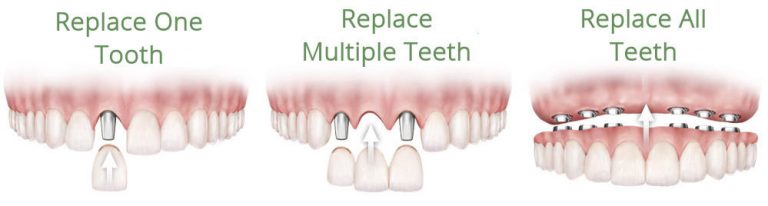

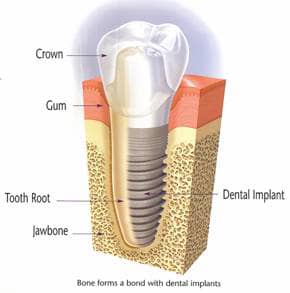

Yes if they are not merely cosmetic and the dentist has recommended them as treatment for your dental condition. For example if your insurance covers 80 of the cost of treatment for denture implants or dental implants you are responsible for paying the remaining 20. Medical care including dental implants is a deductible expense.

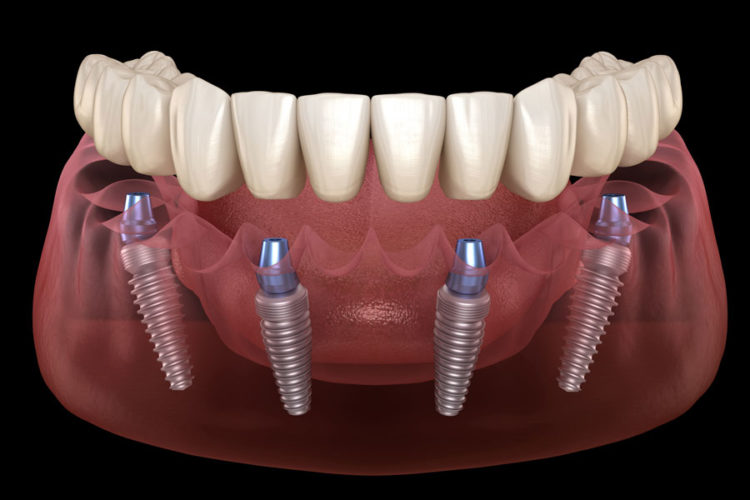

If youre wondering whether cosmetic surgery dental implants LASIK or other medical expenses are tax deductible the IRS has a document for you. This brings us back to the question Are porcelain crowns dental implants and fillings medically necessary. Can I deduct the cost of my all on 4 dental implants Accountants Assistant.

By taking this deduction on your tax return you receive a tax refund of roughly 11 281. Expenses related to OTC toothpaste dental floss mouthwash and general care products are typically not considered tax-deductible either. For future reference keep in mind that for 2019 dentalmedical expenses must exceed 10.

If you are 65 or over they are deductible to the extent they exceed 75 Please click here for more information. You can claim the portion of the procedure that you pay also known as the co-pay. Many emergency and restorative services are also tax deductible such as root canal therapy braces and dental implants.

This is specifically mentioned so that helps if it ever came to an audit. Please tell me more so we can help you best. While dental implants arent specifically mentioned in IRS Publication 502 the IRS says.

Preventive services such as routine professional cleanings and exams are tax deductible. The Accountant will know how to help. For example if youre a federal employee participating in the premium conversion plan of the Federal Employee.

That 20 is the portion you can. The only exception is dental work that is purely cosmetic such as teeth whitening. Yes dental implants are an approved medical expense that can be deducted on your return.

Per the IRS Deductible medical expenses may include but arent limited to the following. However to deduct medical expenses it will mean itemizing your deductions. Even if you have insurance coverage that includes implant treatment you could still receive a tax credit.

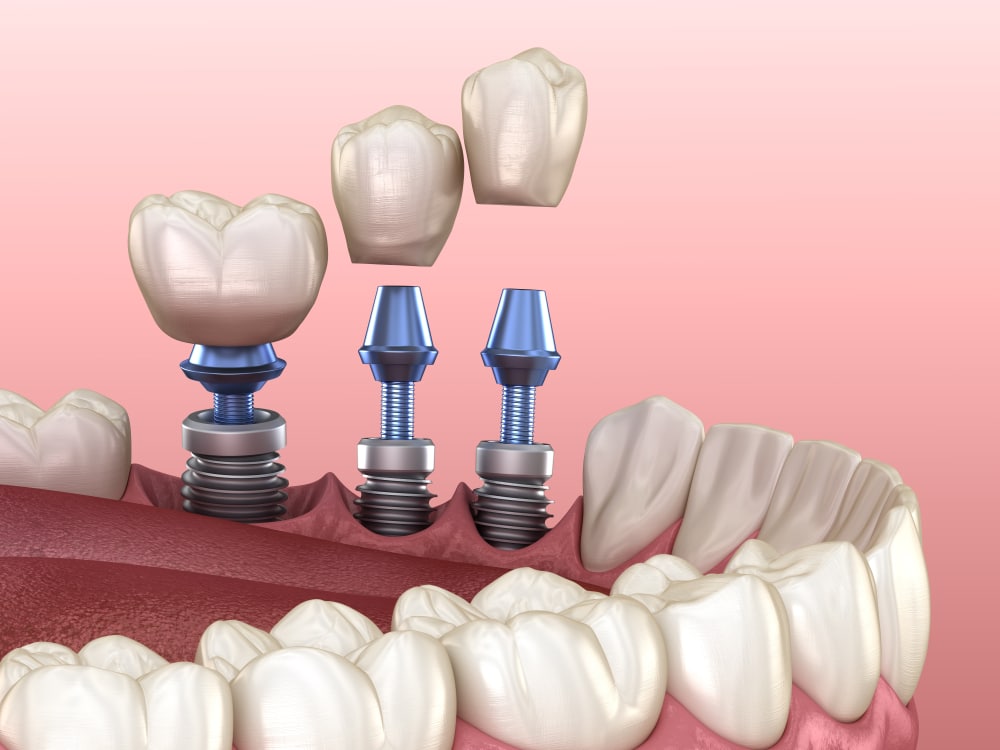

Preventive treatment includes the services of a dental hygienist or dentist for such procedures as teeth cleaning the application of sealants and fluoride. Cosmetic treatments are an exception. One full arch of teeth four dental implants.

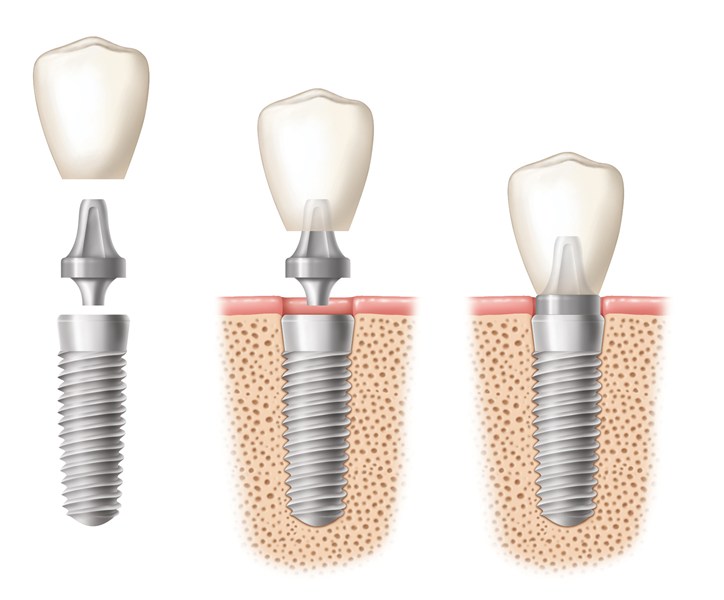

It also explains Medical care expenses include payments for the diagnosis cure mitigation. Dental implants count because they affect the structure and function of your body. Most dental expenses can be used as medical expense deductions when filing your income taxes in Canada including.

If any of your expenses were reimbursed by insurance your expenses must be reduced by the amount of the reimbursement. If the tax refund was applied immediately to the loan and the loan was refinanced the new payment would be approximately 329 with the interest portion of the loan being again tax deductible over its.

Dental Implants Cost In Palos Verdes And South Bay California

Dental Implant Cost Santa Fe Nm Taos Nm Los Alamos Nm Oral Surgery And Dental Implant Center Of Santa Fe

12 Easy Ways To Get Affordable Dental Implants In 2022 Authority Dental

Dental Implant Cost Near Me Clear Choice Cost Maryland

Dental Implant Cost Santa Fe Nm Taos Nm Los Alamos Nm Oral Surgery And Dental Implant Center Of Santa Fe

Dental Implant Financing Feeds Low Monthly Payment Plans

All On 4 6 Full Arch Implant Surgery With Immediate Loading Live Patient Program Itc Seminars

/BestDentalInsuranceforImplants-5c56e663e267499a8011f1e26d260841.jpg)

Best Dental Insurance For Implants Of 2022

Dental Implant Cost Costa Mesa How Much Does Single Tooth Implant Cost In Orange County Dentistry At Its Finest

Are Dental Implants Worth It Pros Cons

Are Dental Implants Tax Deductible Atlanta Dental Implants

How Can United Medical Credit Help Me With Dental Implant Financing United Medical Credit

12 Easy Ways To Get Affordable Dental Implants In 2022 Authority Dental

Dental Implant Cost Santa Fe Nm Taos Nm Los Alamos Nm Oral Surgery And Dental Implant Center Of Santa Fe

Implants Dental Insurance Medi Cal Medicare Hsa

Perfit Are Denture Implants And Dental Implants A Cra Tax Credit